Your cart is currently empty!

SAP for Accounts Payable: Automate & Simplify Your Financial Operations

Posted Date:

The world of accounts payable can be a complex one, filled with invoices, purchase orders, and keeping track of every penny owed. But what if there was a way to streamline this process, automate tedious tasks, and gain valuable insights into your spending? Enter SAP for accounts payable – a powerful tool that can revolutionize the way you manage your finances.

The Accounts Payable Journey

Before diving into automation, let’s understand the core accounts payable process:

- Identifying Needs: It all starts with identifying the need for materials or services.

- Vendor Selection: Potential suppliers are evaluated, and contracts are established.

- Vendor Creation: These suppliers are then added to your SAP system for easy tracking.

- Purchase Orders: Official orders are placed with the chosen vendors for the required goods or services.

- Delivery & Service Verification: Upon receiving the materials or completing services, proper documentation is completed.

- Invoice Processing: Invoices are received, reviewed, and validated for accuracy.

- Payment Processing: Approved invoices are paid according to agreed-upon terms.

The Power of Automation

Manual tasks in accounts payable can be time-consuming and prone to errors. This is where SAP automation comes in. By automating repetitive tasks like data entry, invoice approval workflows, and even payment processing, SAP streamlines your entire AP process, freeing up valuable staff time and resources.

Benefits of AP Automation with SAP

- Enhanced Efficiency: Automating manual tasks reduces processing times and allows staff to focus on higher-value activities.

- Improved Accuracy: Data entry errors are minimized, leading to cleaner financial records and better reporting.

- Early Payment Discounts: Automated workflows ensure timely invoice processing, helping you capitalize on early payment discounts offered by vendors.

- Increased Visibility: Gain real-time insights into your spending habits, allowing for better budgeting and forecasting.

- Reduced Costs: Automation helps lower operational costs associated with manual processing.

Exploring SAP for accounts payable Key Features

SAP offers a comprehensive suite of features for managing accounts payable, including:

- Parked Invoices: Hold invoices temporarily for further review or clarification before processing.

- Blocked Invoices: Identify and address invoices on hold due to missing information or discrepancies.

- Cash Discount Utilization: Track the effectiveness of your efforts to leverage early payment discounts.

- Payable Aging Reports: Analyze outstanding invoices by age to prioritize payments and optimize cash flow.

- Supplier Management: Maintain detailed records of your vendors for better collaboration.

- Real-time Reporting & Analytics: Gain valuable insights into your spending patterns and identify areas for improvement.

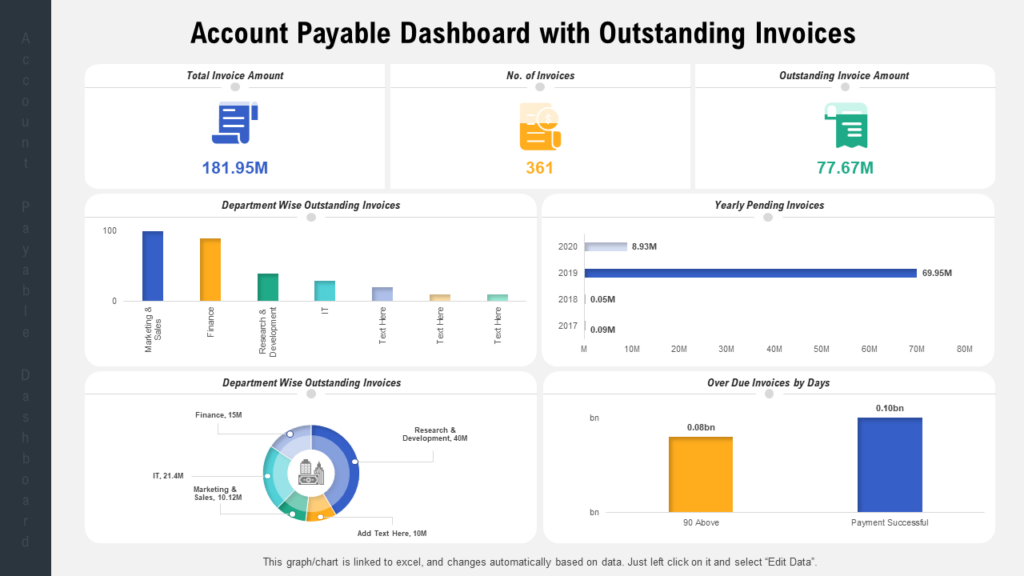

Beyond Features: Your SAP Accounts Payable Dashboard

Your SAP accounts payable dashboard provides a central hub for managing all your AP tasks and activities. Here, you’ll find:

- My Inbox: Prioritized to-do list showcasing tasks that require your attention.

- Due Invoices Free for Payment: Quickly identify invoices ready for processing and payment.

- Invoice Processing Statistics: Monitor the efficiency and effectiveness of your AP processes.

Frequently Asked Questions:

- Which SAP module is used for accounts payable?

- The SAP FI (Financial Accounting) module is primarily used for accounts payable functions.

- Does SAP offer AP automation?

- Yes, SAP offers various tools and functionalities to automate accounts payable processes.

- What are T-codes in SAP for accounts payable?

- T-codes are transaction codes used to access specific functions. Common AP T-codes include FK01 (create vendor), FB60 (enter invoice), and FK03 (display vendor master data).

- What is an AP invoice in SAP?

- An AP invoice in SAP refers to a supplier’s bill for goods or services received, entered into the system for processing and payment.

Conclusion

By leveraging SAP for accounts payable, you can transform your financial operations. From streamlining workflows to gaining valuable insights, SAP empowers you to manage your finances with greater efficiency and control. Take the first step towards a more efficient process – explore the power of SAP today!

You may be interested in:

Accounts Payable module flow with base tables

SaaS vs SAP Showdown for Modern Businesses

AI tools for SAP application development

Categories:

Hi, this is a comment. To get started with moderating, editing, and deleting comments, please visit the Comments screen in…